By Jeff Bernier

Are you retired with an investment portfolio and the need to provide reliable income for the rest of your life?

Did you just come into some serious money from an inheritance or the sale of a business?

Are you a busy, dual income family with a “full plate” and no time to think strategically?

Are you a new investor trying your hand at picking “winners” on new digital investment platforms?

Regardless of life circumstances, many people believe that if they could accurately forecast the future, they could meet their investment goals. And, where there is a desire for something, the free market will provide it. Welcome to Forecast Season. It’s that time of year! Of course, there is nothing special about January to December as the appropriate time to measure, we are just programmed to think in terms of the calendar year.

Supply has certainly grown to meet the demand for forecasts. You’ve seen them—from the financial media, money managers, your golf buddy, and most likely your last taxi driver (or should I say Uber driver?). We want to know the future so that we can improve outcomes. Heck, even yours truly – an evidence-based, behavioral investment counselor – can’t help but listen when one of our investment partners begins to wax eloquently on the direction of the economy, markets, interest rates, etc. Just proves that, even if we know better, we cannot help ourselves. I was pleased to read a while back that that Nobel Prize winning behavioral economist Daniel Kahneman admitted that a distinguished career studying behavioral mistakes did not insulate him from still making them!

When clients ask for our forecast, I feel like pulling out a recording of my response, since it does not change. WE DON’T MAKE FORECASTS. For some who have worked with traditional Wall Street firms, this can come as a surprise. While there are others, here are three reasons we don’t play the forecast game:

- There are not good forecasters. Research shows that when it comes to predicting economic growth, interest rates, currencies, or the stock market, the only value of investment gurus is to make weather forecasters look good. One of the most admired investors of our lifetime, Warren Buffett, advises investors to ignore all forecasts in that they tell you little about the direction of the markets but a lot about the person doing the predicting.

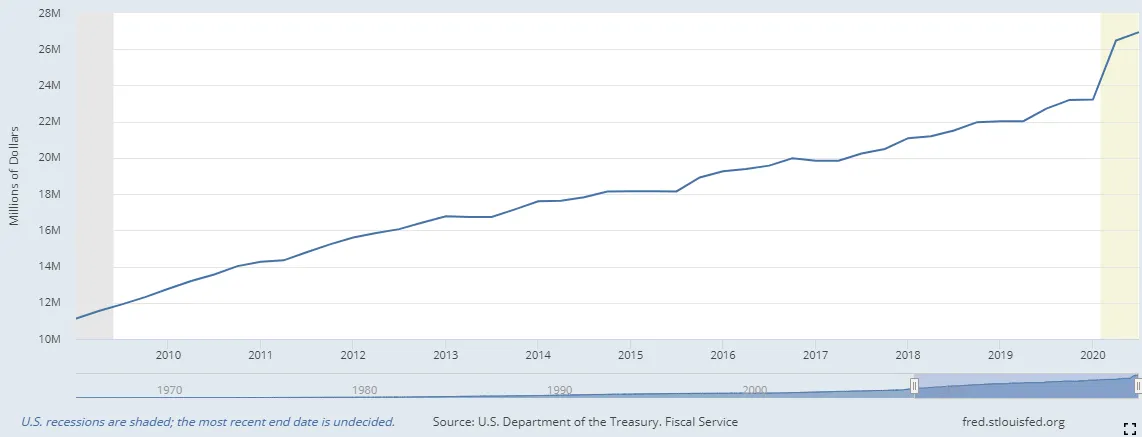

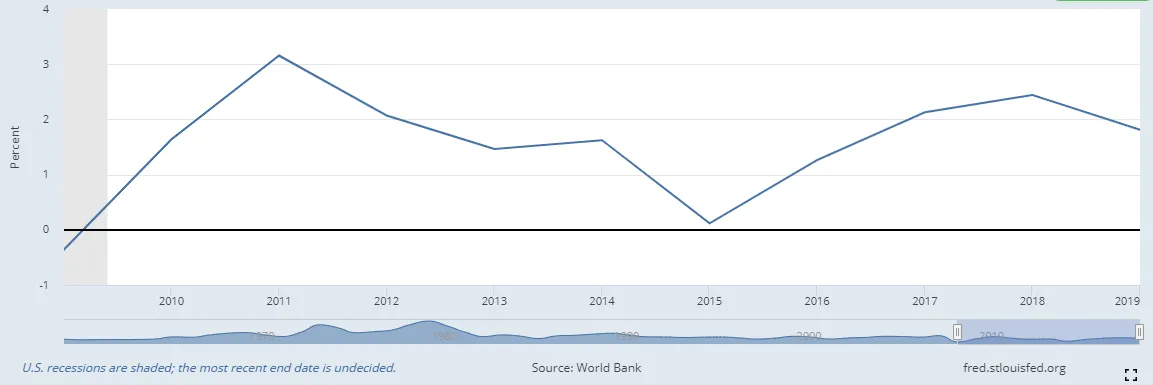

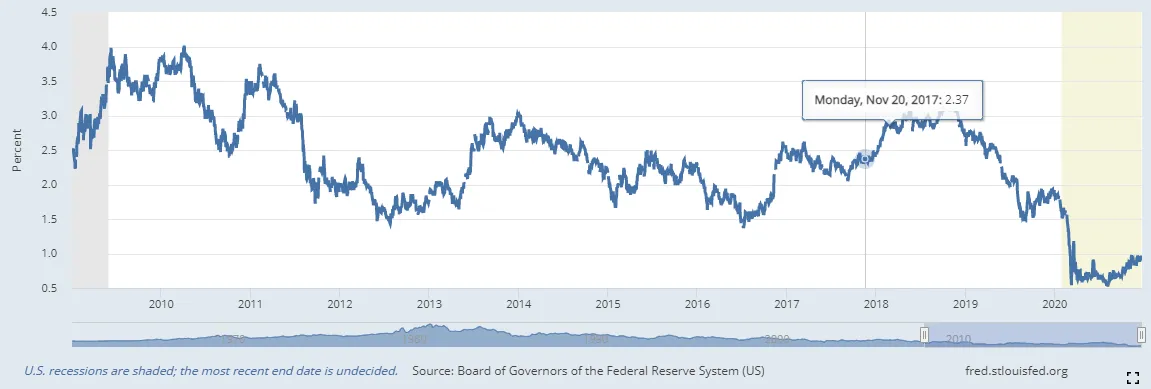

- Even if we could accurately predict the direction of the economy, politics, world events, or transformational technological advances, it would not help. We do not have to go very far back to see examples of this. On March 23rd there were 40,000 reported COVID-19 cases and 473 deaths. If I had told you with certainty that by the end of the year there would be over 18 million cases and 330,000 deaths, would you have forecasted that U.S. equities (the S&P 500 Index) would be up 60% from the March 23rd level? Would you have forecasted a 60% rise from March 2009 to October 2009 if I had accurately predicted in March that unemployment levels would peak at 10% in October? Or how about this example for the more visually inclined. If I accurately forecasted in 2009 that in the next 10 years the size of the Federal debt would almost triple, would we have also predicted that annual inflation would be 2% and Treasury Bond yields would fall from 4% to less than 1%?

The Federal Debt (11 Trillion – 27 Trillion)

Inflation

10 Year Treasury Yields

- For a long-term investor, the short- to intermediate-term does not matter that much. Your saving and spending decisions and long-term perspective will have more impact on your ultimate success building financial security than the accuracy with which you predict events. Even if you are a most unlucky market timer, with a long enough horizon, historically, you would still be ok if you did not panic. (See this video from Ben Carslon: What if you only invested at market peaks?) And long term does not mean from now until baseball spring training! It could mean over twenty years if you are under 70, half a century if you are 50, and even longer if you have offspring you’d like to bless with financial legacies. (Yep, with medical advances we should prepare for longer life expectancies.)

Let me make clear that a policy of NO FORECASTING does not mean that we should not build reasonable return expectations into a financial plan. I have written extensively about the need to use projected returns instead of simply extrapolating the past in building financial projections. The market does not care how much return you need. If the risk-free interest rate is low and if some asset classes are historically expensive, it would not be prudent to ignore this as we project possible futures.

Planning is Always In Season!

If we are to skip Forecast Season, what can we do? Here are 6 suggestions:

- Know Thy Self. Take some time to reflect on “what (and who) matters most”. Clearly identify your goals and concerns. Gain clarity on who you are as an investor. The financial writer George J.W. Goodman, who wrote under a pen name of Adam Smith, once wrote: “If you don’t know who you are, this (Wall Street) is an expensive place to find out.”

- Hire a Guide. The two greatest golfers of our time (Tiger and Jack) both had / have coaches. For something as serious as your financial future, you might want to consider seeking a financial “coach”.

- Build a Plan. Eisenhower, when he was overall Commander of Allied Forces in WWII, famously said, “In preparing for battle I have always found that plans are useless but planning is indispensable.”

- Follow the Plan – but have a “Plan B and C, and maybe D”. A good financial sherpa can help here. Life happens – an objective, caring partner can help you evaluate options and tradeoffs. One more quote: When Mike Tyson was asked by a reporter whether he was worried about an upcoming opponent and his fight plan he answered: “Everyone has a plan until they get punched in the mouth.”

- Play the Long Game. Looking at historical returns, the S&P 500 Index is positive about 52% of the trading days—only slightly better than 50% of the time. This means if you check the stock market on your smart phone every day, about half of the time you are likely to feel like you’re losing. If you checked your portfolio balance quarterly, you’d be unhappy about 30% of the time. If you checked it annually, you’d be unhappy about 26% of the time. But if you only checked every 10 years, you’d be happy 95% of the time, (the depression and the financial crisis being the notable exceptions). Of course, a recommended diversified portfolio would likely have less volatile results than these.

- Live your Life. Remember, your financial plans are a “means to an end.” Return on Life is as important as Return on Investment.

Please join us on

Thursday, January 28th at 5:15pm for our Semi-Annual Investment Review

where we will release the TandemGrowth 2021 Market and Economic Forecast…just kidding…there will be NO FORECAST!

As usual, we will cover our take on recent market and economic events, provide a review of JP Morgan’s Guide to the Markets, and share a few thoughts on diversified portfolios and the evolution of our evidence-based investment approach.